HackLive IV - Guided Community Hackathon - TimeSeries

Prophet Forecasts Stock Prices

Go there and register to be able to download the dataset and submit your predictions. Click the button below to open this notebook in Google Colab!

A stock market, equity market or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include securities listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms.

The secret of a successful stock trader is being able to look into the future of the stocks and make wise decisions. Accurate prediction of stock market returns is a very challenging task due to volatile and non-linear nature of the financial stock markets. With the introduction of artificial intelligence and increased computational capabilities, programmed methods of prediction have proved to be more efficient in predicting stock prices.

Here, you are provided dataset of a public stock market for 104 stocks. Can you forecast the future closing prices for these stocks with your Data Science skills for the next 2 months?

# import libs

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style('whitegrid')

from fbprophet import Prophet

import multiprocessing

from joblib import Parallel, delayed

# load data and set seed

BASE = 'https://drive.google.com/uc?export=download&id='

SEED = 2021

train = pd.read_csv(f'{BASE}1H3EhyeZ5YJi6OHjMtvWO1TpPcS-C-SYG', parse_dates=['Date']) # parse Date column right away

test = pd.read_csv(f'{BASE}1GRJpiV_fLkhE3MUPxpDcdQ-Xz-4OFKcN', parse_dates=['Date'])

ss = pd.read_csv(f'{BASE}1kOhLBDZyeONgF1NmVnc2Q2bq847VGm_V')

EDA

First we look at the first few rows of the train and test dataset. Also double check that dates were parsed correctly.

train.head()

| ID | stock | Date | Open | High | Low | Close | holiday | unpredictability_score | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | id_0 | 0 | 2017-01-03 | 82.9961 | 82.7396 | 82.9144 | 82.8101 | 1 | 7 |

| 1 | id_1 | 0 | 2017-01-04 | 83.1312 | 83.1669 | 83.3779 | 82.9690 | 0 | 7 |

| 2 | id_2 | 0 | 2017-01-05 | 82.6622 | 82.7634 | 82.8984 | 82.8578 | 0 | 7 |

| 3 | id_3 | 0 | 2017-01-06 | 83.0279 | 82.7950 | 82.8425 | 82.7385 | 0 | 7 |

| 4 | id_4 | 0 | 2017-01-09 | 82.3761 | 82.0828 | 82.1473 | 81.8641 | 0 | 7 |

test.head()

| ID | stock | Date | holiday | unpredictability_score | |

|---|---|---|---|---|---|

| 0 | id_713 | 0 | 2019-11-01 | 0 | 7 |

| 1 | id_714 | 0 | 2019-11-04 | 0 | 7 |

| 2 | id_715 | 0 | 2019-11-05 | 0 | 7 |

| 3 | id_716 | 0 | 2019-11-06 | 0 | 7 |

| 4 | id_717 | 0 | 2019-11-07 | 0 | 7 |

train.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 73439 entries, 0 to 73438

Data columns (total 9 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 ID 73439 non-null object

1 stock 73439 non-null int64

2 Date 73439 non-null datetime64[ns]

3 Open 73439 non-null float64

4 High 73439 non-null float64

5 Low 73439 non-null float64

6 Close 73439 non-null float64

7 holiday 73439 non-null int64

8 unpredictability_score 73439 non-null int64

dtypes: datetime64[ns](1), float64(4), int64(3), object(1)

memory usage: 5.0+ MB

test.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 4223 entries, 0 to 4222

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 ID 4223 non-null object

1 stock 4223 non-null int64

2 Date 4223 non-null datetime64[ns]

3 holiday 4223 non-null int64

4 unpredictability_score 4223 non-null int64

dtypes: datetime64[ns](1), int64(3), object(1)

memory usage: 165.1+ KB

# define ID and target column names

ID_COL, TARGET_COL = 'ID', 'Close'

# define predictors

features = [c for c in train.columns if c not in [ID_COL, TARGET_COL]]

# look at train and test sizes

train.shape, test.shape

((73439, 9), (4223, 5))

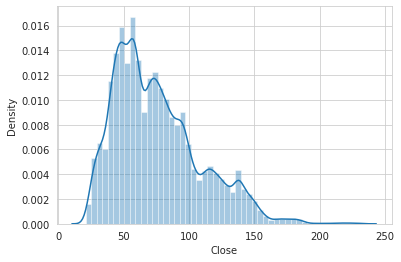

# plot target distribution

sns.distplot(train[TARGET_COL]);

/usr/local/lib/python3.7/dist-packages/seaborn/distributions.py:2557: FutureWarning:

`distplot` is a deprecated function and will be removed in a future version. Please adapt your code to use either `displot` (a figure-level function with similar flexibility) or `histplot` (an axes-level function for histograms).

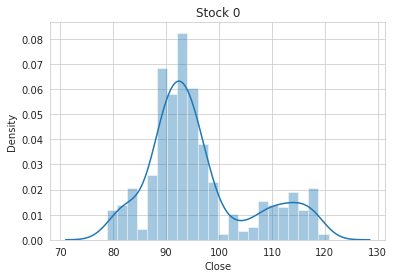

# plot target distribution for a single stock

STOCK_NO = 0

sns.distplot(train.loc[train['stock'] == STOCK_NO, TARGET_COL]).set_title(f'Stock {STOCK_NO}');

/usr/local/lib/python3.7/dist-packages/seaborn/distributions.py:2557: FutureWarning:

`distplot` is a deprecated function and will be removed in a future version. Please adapt your code to use either `displot` (a figure-level function with similar flexibility) or `histplot` (an axes-level function for histograms).

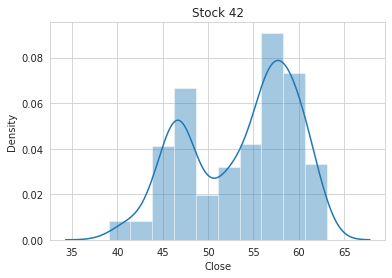

# plot target distribution for a different stock

STOCK_NO = 42

sns.distplot(train.loc[train['stock'] == STOCK_NO, TARGET_COL]).set_title(f'Stock {STOCK_NO}');

/usr/local/lib/python3.7/dist-packages/seaborn/distributions.py:2557: FutureWarning:

`distplot` is a deprecated function and will be removed in a future version. Please adapt your code to use either `displot` (a figure-level function with similar flexibility) or `histplot` (an axes-level function for histograms).

# unique values in each variable

train.nunique()

ID 73439

stock 103

Date 713

Open 60702

High 60594

Low 61015

Close 60352

holiday 2

unpredictability_score 10

dtype: int64

test.nunique()

ID 4223

stock 103

Date 41

holiday 2

unpredictability_score 10

dtype: int64

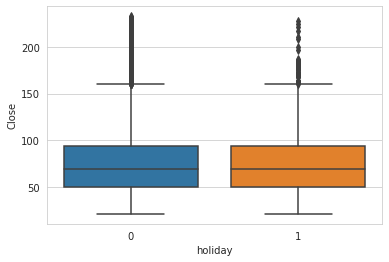

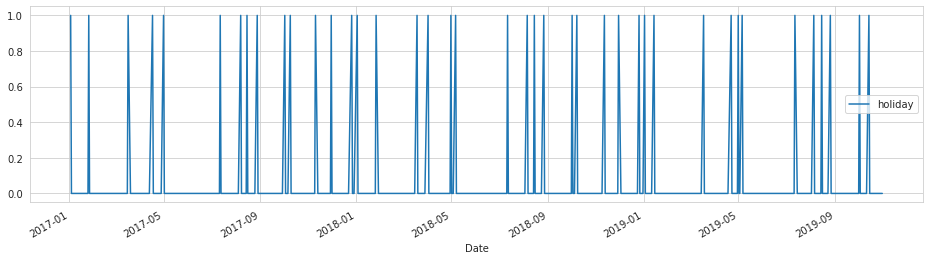

# explore holiday variable

print(train['holiday'].value_counts())

sns.boxplot(x = train['holiday'], y = train[TARGET_COL]);

0 69216

1 4223

Name: holiday, dtype: int64

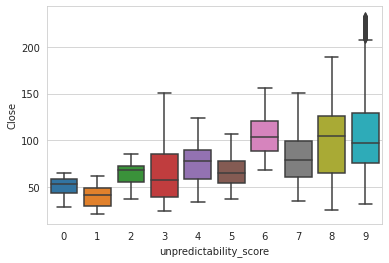

# explore unpredictability_score

print(train['unpredictability_score'].value_counts())

sns.boxplot(x = train['unpredictability_score'], y = train[TARGET_COL]);

9 7843

4 7843

0 7843

8 7130

7 7130

6 7130

5 7130

3 7130

2 7130

1 7130

Name: unpredictability_score, dtype: int64

# date ranges

print(train['Date'].min(), train['Date'].max())

print(test['Date'].min(), test['Date'].max())

2017-01-03 00:00:00 2019-10-31 00:00:00

2019-11-01 00:00:00 2019-12-31 00:00:00

# plot holidays in train

train.set_index('Date')[['holiday']].plot(figsize=(16, 4));

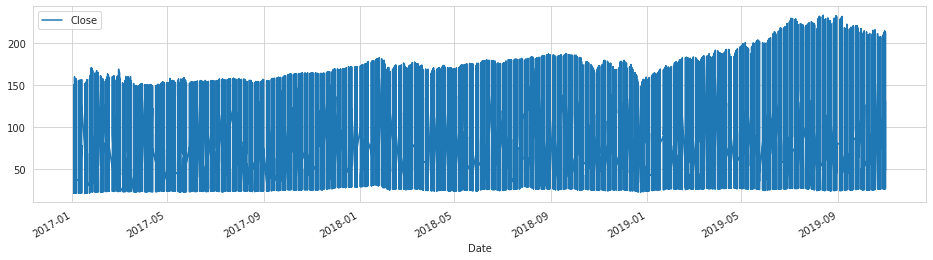

# plot Close

train.set_index('Date')[[TARGET_COL]].plot(figsize=(16, 4));

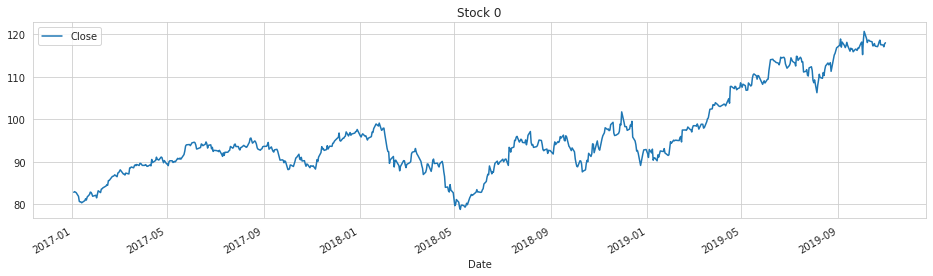

# plot Close for a single stock

STOCK_NO = 0

train.loc[train['stock'] == STOCK_NO].set_index('Date')[[TARGET_COL]].plot(figsize=(16, 4), title = f'Stock {STOCK_NO}');

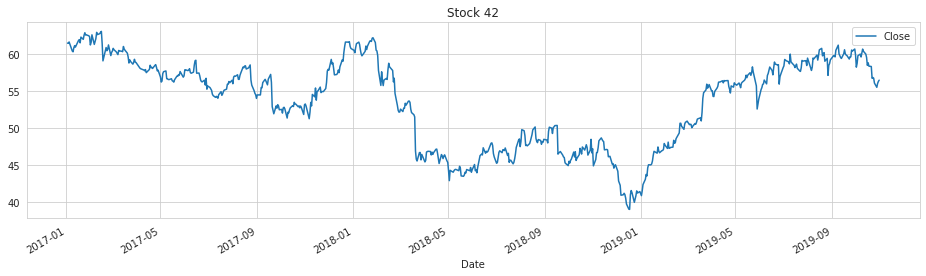

# plot Close for a different stock

STOCK_NO = 42

train.loc[train['stock'] == STOCK_NO].set_index('Date')[[TARGET_COL]].plot(figsize=(16, 4), title = f'Stock {STOCK_NO}');

Observations

No null values in these datasets. Training dates are from January 2017 to Halloween 2019, test dates are November and December 2019.

We should predict future stock price for 104 different stocks based only on Date, holiday flag (1/0) and an unpredictability_score (1-9).

Closing amount does not seem to differ too much on holidays compared to normal days. Volatility definitely rises with increasing unpredictability_score, as expected. Counts in each score are quite balanced, with 9, 4, and 0 being slightly more common - worth more exploration in the future.

Baseline FB Prophet model!

Let’s define a parallelised Prophet prediction pipeline to speed up the prediction for 104 stocks separately.

Credit for this idea goes to this kaggle kernel.

# Forecast function:

def ProphetFC(stock_no: int):

'''

Predict test prices for each stock separately.

:param stock_no: Stock ID to predict

:returns: Forecasted future dataframe, as return by prophet's .predict method

'''

# Create Prophet model

m = Prophet()

# Create df, add features and fit

tsdf = pd.DataFrame({

'ds': train.loc[train['stock'] == stock_no, 'Date'].reset_index(drop=True),

'y': train.loc[train['stock'] == stock_no, TARGET_COL].reset_index(drop=True),

})

tsdf['holiday'] = train.loc[train['stock'] == stock_no, 'holiday'].reset_index(drop=True)

tsdf['unpredictability_score'] = train.loc[train['stock'] == stock_no, 'unpredictability_score'].reset_index(drop=True)

m.add_regressor('holiday')

m.add_regressor('unpredictability_score')

m.fit(tsdf)

# create future df and predict

future = pd.DataFrame({

'ds': test.loc[test['stock'] == stock_no, 'Date'].reset_index(drop=True),

})

future['holiday'] = test.loc[test['stock'] == stock_no, 'holiday'].reset_index(drop=True)

future['unpredictability_score'] = test.loc[test['stock'] == stock_no, 'unpredictability_score'].reset_index(drop=True)

fcst = m.predict(future)

fcst[ID_COL] = test.loc[test['stock'] == stock_no, ID_COL]

fcst['stock'] = stock_no

return fcst

%%time

# how many stocks to predict for

NUM_STOCKS = train['stock'].nunique()

# parallel jobs to forecast

num_cores = multiprocessing.cpu_count()

processed_FC = Parallel(n_jobs=num_cores)(delayed(ProphetFC)(i) for i in range(NUM_STOCKS))

CPU times: user 3 s, sys: 160 ms, total: 3.16 s

Wall time: 5min 15s

# combining obtained dataframes

FCAST = pd.concat(processed_FC, ignore_index=True)

FCAST.head()

| ds | trend | yhat_lower | yhat_upper | trend_lower | trend_upper | additive_terms | additive_terms_lower | additive_terms_upper | extra_regressors_additive | extra_regressors_additive_lower | extra_regressors_additive_upper | holiday | holiday_lower | holiday_upper | unpredictability_score | unpredictability_score_lower | unpredictability_score_upper | weekly | weekly_lower | weekly_upper | yearly | yearly_lower | yearly_upper | multiplicative_terms | multiplicative_terms_lower | multiplicative_terms_upper | yhat | ID | stock | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2019-11-01 | 123.836651 | 117.992600 | 122.187867 | 123.836651 | 123.836651 | -3.858359 | -3.858359 | -3.858359 | -0.083126 | -0.083126 | -0.083126 | 0.0 | 0.0 | 0.0 | -0.083126 | -0.083126 | -0.083126 | 0.098074 | 0.098074 | 0.098074 | -3.873307 | -3.873307 | -3.873307 | 0.0 | 0.0 | 0.0 | 119.978292 | id_713 | 0 |

| 1 | 2019-11-04 | 124.158461 | 118.541425 | 122.710671 | 124.158461 | 124.158461 | -3.492853 | -3.492853 | -3.492853 | -0.083126 | -0.083126 | -0.083126 | 0.0 | 0.0 | 0.0 | -0.083126 | -0.083126 | -0.083126 | -0.073551 | -0.073551 | -0.073551 | -3.336177 | -3.336177 | -3.336177 | 0.0 | 0.0 | 0.0 | 120.665608 | id_714 | 0 |

| 2 | 2019-11-05 | 124.265731 | 118.865930 | 123.259751 | 124.265731 | 124.265731 | -3.231049 | -3.231049 | -3.231049 | -0.083126 | -0.083126 | -0.083126 | 0.0 | 0.0 | 0.0 | -0.083126 | -0.083126 | -0.083126 | -0.007098 | -0.007098 | -0.007098 | -3.140825 | -3.140825 | -3.140825 | 0.0 | 0.0 | 0.0 | 121.034682 | id_715 | 0 |

| 3 | 2019-11-06 | 124.373002 | 119.118231 | 123.431604 | 124.373002 | 124.373002 | -3.067293 | -3.067293 | -3.067293 | -0.083126 | -0.083126 | -0.083126 | 0.0 | 0.0 | 0.0 | -0.083126 | -0.083126 | -0.083126 | -0.045587 | -0.045587 | -0.045587 | -2.938580 | -2.938580 | -2.938580 | 0.0 | 0.0 | 0.0 | 121.305709 | id_716 | 0 |

| 4 | 2019-11-07 | 124.480272 | 119.611473 | 123.998805 | 124.480272 | 124.480272 | -2.787002 | -2.787002 | -2.787002 | -0.083126 | -0.083126 | -0.083126 | 0.0 | 0.0 | 0.0 | -0.083126 | -0.083126 | -0.083126 | 0.026466 | 0.026466 | 0.026466 | -2.730342 | -2.730342 | -2.730342 | 0.0 | 0.0 | 0.0 | 121.693270 | id_717 | 0 |

# define function to plot predictions

def plot_preds(stock_no: int):

'''

PLot Closes for a certain stock separately.

:param stock_no: Stock ID to plot

:returns: nothing

'''

# create temp train df

train_tmp = train.loc[train['stock'] == stock_no].set_index('Date')[[TARGET_COL]]

train_tmp['type'] = 'train'

# create temp test df

test_tmp = FCAST.loc[FCAST['stock'] == stock_no].rename(columns={"yhat": TARGET_COL, 'ds': 'Date'}).set_index('Date')[[TARGET_COL]]

test_tmp['type'] = 'test'

train_tmp.append(test_tmp).groupby('type')[TARGET_COL].plot(figsize=(16, 4), title = f'Stock {stock_no}', sharex=False, legend=True);

pass

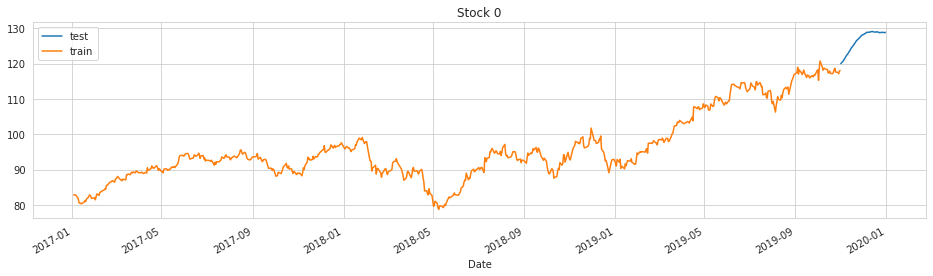

# plot stock 0 with preds

plot_preds(0)

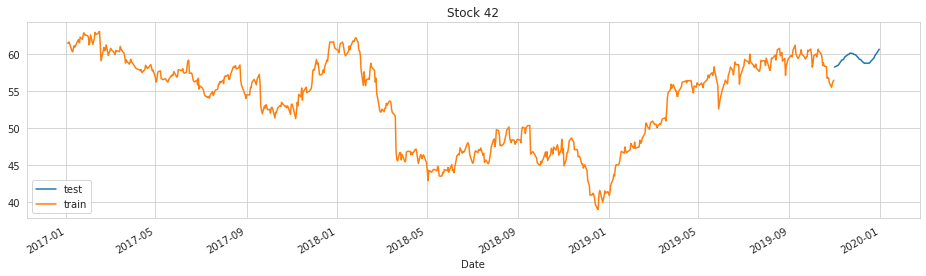

# plot stock 42 with preds

plot_preds(42)

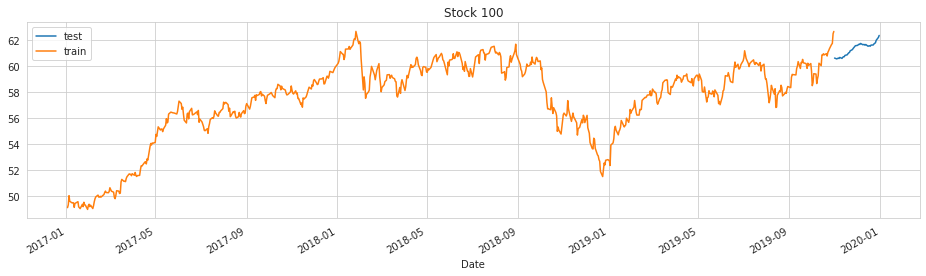

# plot stock 100 with preds

plot_preds(100)

Observations

Clearly some of these predictions do not start where the train set ends, so further iterations are needed (perhaps targeted on holidays, seasonality, and its fourier order) to fix this problem.

# submission

submission = FCAST[['ID', 'yhat']].rename(columns={'yhat': TARGET_COL})

submission.to_csv('submission_prophet_baseline.csv',index=False)

# and we're done!

'Done!'

'Done!'